Cash, in the physical form of coins and later as paper notes, has existed for thousands of years. Minted physical currencies have been the hallmark of every great city-state, nation-state and empire since the beginning of civilisation. When we think of money, we think of physical dollars, pounds, euros or yen. But the time we are living through now is unique in the history of money and how we use it. We are living through the last period in human history to use physical cash. This is a major thematic investment trend: the move away from physical cash and into digital payments in the ‘Cashless Economy’.

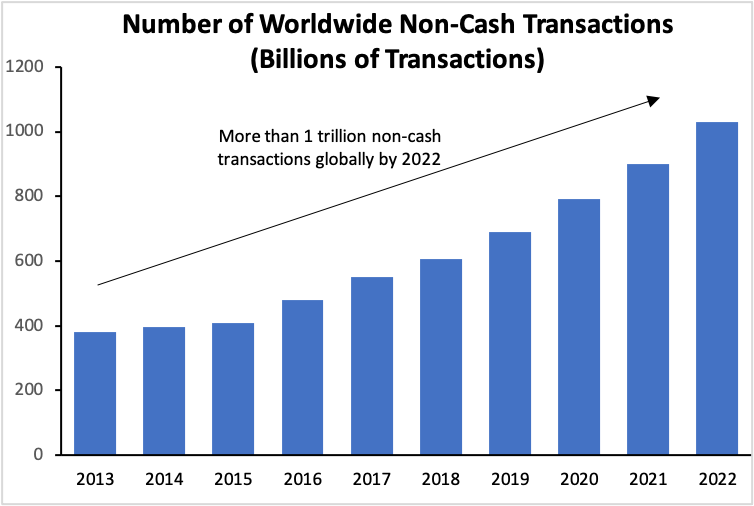

Cash is falling out of favour and has every chance of becoming obsolete before the end of this century. In future decades, people will look at physical cash as a relic from a bygone age. Cash is being supplanted by electronic payments, a permanent change in how the world conducts its economic transactions. On current forecasts, we expect the world to see more than 1 trillion non-cash transactions per year by 2022, and we can see that the growth rate of non-cash transactions is accelerating. By next year, the total number of cashless transactions conducted annually around the world will have increased by more than 150% since 2013.

This change has been a long time coming and electronic payments are nothing new. The first electronic money transfer was conducted in 1871 and the first card payment was processed in 1959. What has changed recently has been the large-scale adoption of contactless and of mobile-based payments. These new technologies have seen major acceleration of the growth in non-cash transactions in recent years. Further accelerating the shift away from physical cash has been the COVID 19 pandemic, with many retail stores refusing physical cash and billions of consumers conducting more of their purchasing over the internet (which requires electronic payment). As with many other aspects of the global economy, COVID has dramatically accelerated a trend already underway, in this case the move away from physical cash and into digital payments.

Digital and electronic payments also offer greater utility than cash. You do not need to mint it, carry it and it cannot be lost down the back of your sofa! All that is needed is a thin plastic card or a phone. Digital payments are faster, safer and easier. Today cash still represents one-third of all worldwide retail transactions, by 2023 this will drop to less than one-fifth and physical cash could be totally obsolete within the next two decades.

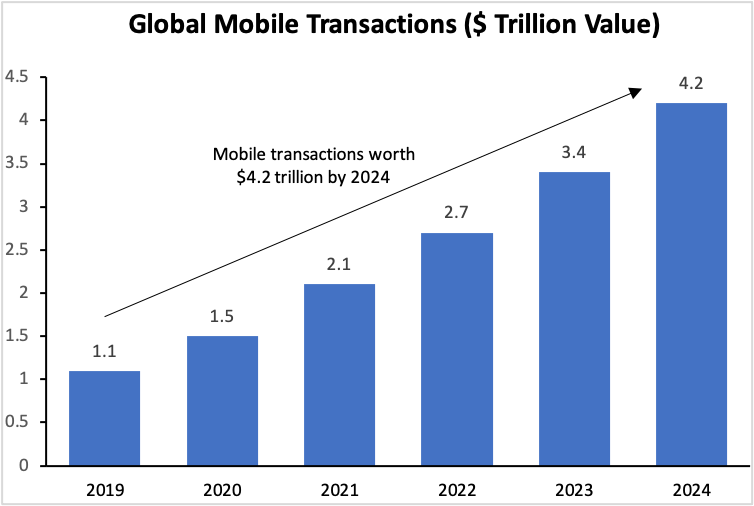

There are also major changes underway within the non-cash payments sector too. An investment theme within a theme! At the forefront of these changes is the shift of digital payments towards more mobile payments (paying with a smartphone rather than a credit/debit card), which will more than triple over the next four years, to an expected total value of $4.2 trillion. While less than one-third of US consumers currently use mobile payments, already 61% of Chinese consumers and 84% of smartphone owners there transact with their phones. Mobile payments are set to be a major growth industry for many years to come.

The shift towards the cashless economy is a very exciting investment trend and we believe a potential source of returns for investors for many years to come. Investors should consider allocating to thematic investment strategies with exposure to long-term structural trends like this. These themes are fundamental changes in how the world works, trends which continue to power ahead through pandemics, recessions and any other risk that may appear in the future. The rise of non-cash transactions and mobile payments is a fantastic example of a thematic investment trend. This trend is a fundamental shift in how humanity interacts economically, a never before seen change which will continue to power growth in investment names exposed to this trend for many years to come.