The concept of artificial intelligence is as old as civilisation. Today, however, myth and legend are becoming reality with the rise of artificial intelligence systems which are changing the world. AI is a core investment theme for the Dominion Global Trends Funds.

There’s nothing new in the idea of AI, what’s new is the technology to make it a reality.

As functions currently requiring human intelligence are augmented or replaced by AI, economic wealth is created. AI software alone is expected to be a $120bn market by 2025. AI has the potential to create trillions of dollars of new wealth for the global economy as the technology matures and becomes a significant driver of economic growth. In the future, AI will become an increasingly critical tool for businesses and consumers, working alongside decision makers across all industries to facilitate more efficient interactions in the economy. AI is a core investment trend for the Dominion Global Trends Funds and offers investors long-term exposure to this world changing technological development.

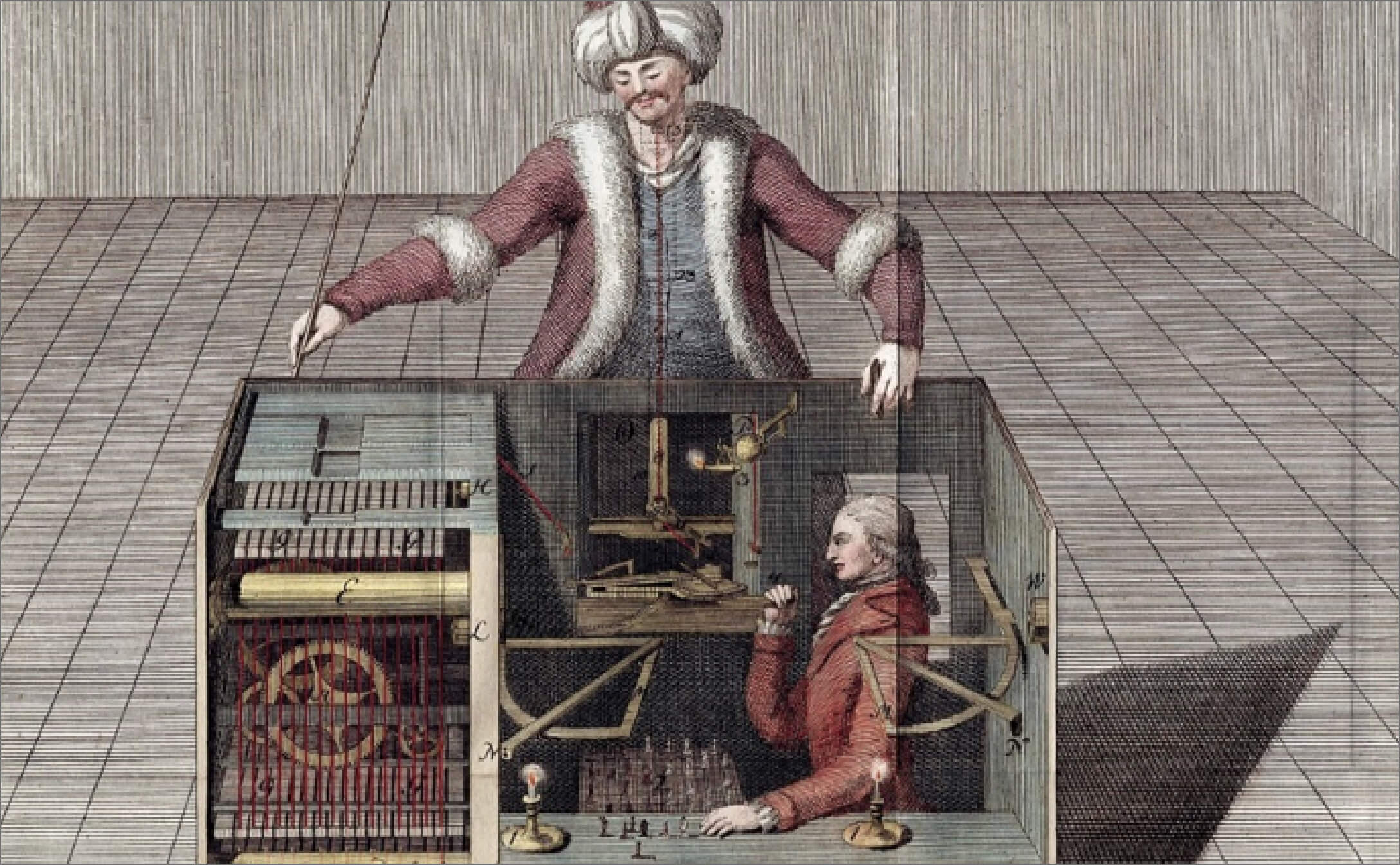

Beware… the Mechanical Turk!

The Schöbrunn Palace in 18th century Vienna is not the first place we would expect to see a functioning artificial intelligence. Putting our historical prejudices aside, this is exactly what attendees of a demonstration of a novel new machine witnessed. In 1770, Wolfgang von Kemplen arrived at the Palace to demonstrate a machine that could play chess against a human opponent... and win. The machine consisted of a model of a human dressed in traditional Ottoman robes with a mechanical hand on-top of a cabinet. A chess board sat in front of the model ‘Turk’. Inside the cabinet was a complicated mechanism of gears and cogs which appeared to drive the model. The cabinet had clear glass doors, so observers could see inside. During this first demonstration, observers could inspect the machine before being asked to nominate one person to challenge it to a game of chess. In this first demonstration, Count Ludwig von Cobenzl was first to play. He was quickly defeated by the machine, which also had the ability to correct mistakes by its opponent and communicate with observers using a letter board. Observers at the time were so amazed at the artificial intelligence displayed by the machine that it became a sensation in 18th century Europe, even playing and defeating Napoleon Bonaparte and Benjamin Franklin.

The truth was much simpler. As the image below shows, the secret of the machine was that it was operated by a human inside the cabinet. The cabinet was designed to make observers think there was only a complex mechanism in the cabinet, creating the illusion of an artificial intelligence. The machine’s inventor benefitted financially from creating a fake artificial intelligence.

The lesson of the Mechanical Turk has not been forgotten. A recent study looked at more than 2,000 tech start-ups in Europe who classify themselves as ‘AI’ businesses. Of those companies, 40% did not have any AI in their products. Of the remaining 60%, the majority were simply using statistics and data analysis, relatively basic tools available to anyone with a mathematics degree and most certainly not real AI. Only a small fraction, less than 10%, of the companies that claimed to be AI businesses are real AI companies. Those companies that are creating real and sustainable competitive AI systems, which will change product and service users experience in a meaningful way, represent a small minority of companies claiming AI status. These are the companies that investors should be invested in. Investors must avoid being invested in the Mechanical Turk, an AI investment product or stock that has no real AI technology and is simply posing as AI.

Companies that claim to be AI businesses command higher valuations, especially at the venture capital stage of funding. This incentivizes companies to claim to be AI when they are not. This becomes a problem for investors who are looking for AI exposure through ETFs or funds dedicated only to AI. Funds only invested in AI will likely contain many of these ‘Mechanical Turks’, companies which claim to be AI but are actually driven by humans using readily available statistical tools.

Finding the real AI opportunities requires in-depth research and expertise in technology investing. At Dominion, we have focused intently on looking for these real AI businesses, with meaningful technology leadership and the ability to leverage their business models to take advantage of AI. Our Global Trends investment philosophy has driven our thinking on AI investment. This has led us to only invest in those AI businesses that match our criteria of competitive advantage through data, technology lead, and strong long-term growth outlook. This means investors in our funds have exposure to this trend in an optimal way and are not exposed to the potential downside of a decline in AI company valuations that an ETF may be exposed to.

So... What is AI?

Artificial intelligence (AI) is the development of computer systems to perform tasks that would traditionally require human intelligence to be performed. Today AI is already being used in a broad range of tasks including speech recognition, visual perception, decision making, data matching and data analysis. It is a core technology in the development of self-driving cars, advanced-automated manufacturing, internet search, targeted advertisement, content censoring and entertainment. As AI technology improves, it will be used in an increasing number of tasks and will eventually be as ubiquitous for business and consumers as the personal computer is today.

Most AI applications today are specialized, with AI systems required to perform specific functions and improve at those functions over time. In healthcare, for example, AI is now being used to read scans of patients’ bodies to detect cancer. These AI systems can already achieve a higher accuracy of correct diagnosis of scan images than doctors and can do it at a much faster speed. What is more, the accuracy of these diagnoses improves over time. The more the AI system practices, the better it gets at its function. This is a core attribute of AI technology, the characteristic of machine self-learning. This is when the AI algorithm improves itself over time and the rate of improvement increases as the amount of data processed increases. This is the machine equivalent of trial and error.

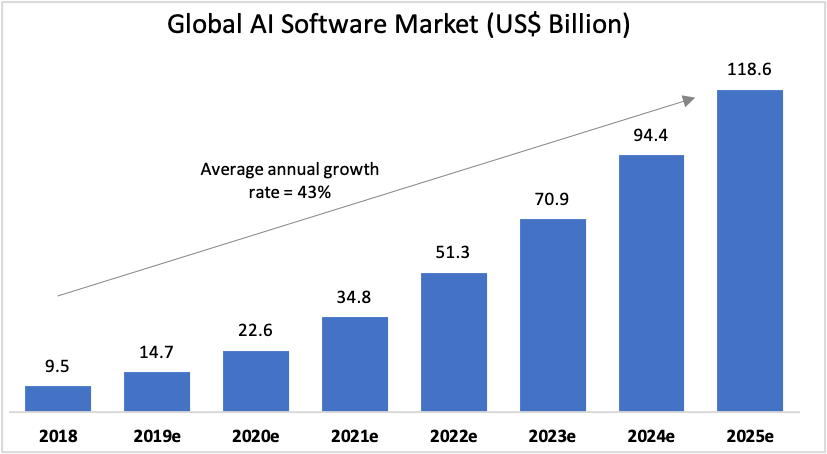

The massive increase in data and soaring computational power at decreasing costs has made AI a commercial reality. More data makes AI systems better at doing their job. This makes data very valuable. Those companies that have the largest amount of data for a given AI task therefore have a major advantage in creating the best AI in that field. Today, the global AI software market is estimated to be worth $9.5 billion and is growing annually at +43%. This market is predicted to be worth $119 billion in just 6 years-time.

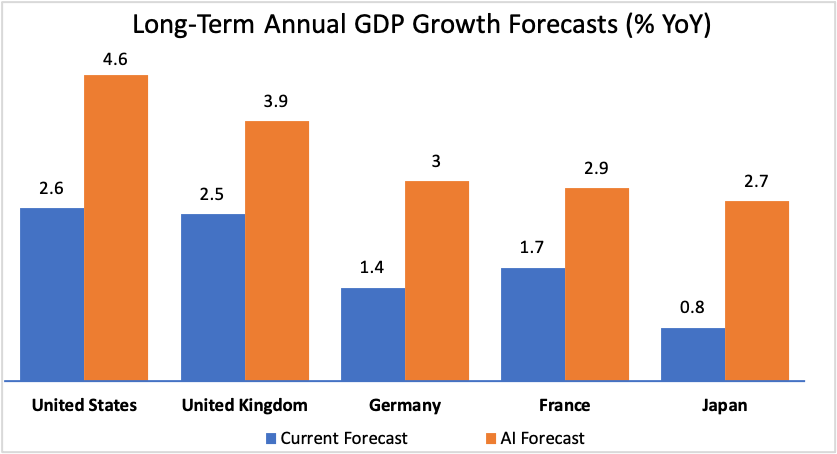

Research by the consultancy Accenture indicates that if AI continues to mature and is rolled out across industries in developed world economies, the effect could be to increase long-term economic growth rates substantially. The results of the analysis are shown below and predict AI could increase the long-term annual growth-rate of GDP in the US from +2.6% to +4.6%, for the UK this increase is from +2.5% to +3.9%, for Germany from +1.4% to +3%.

This difference in growth rates represents trillions of dollars worth of new economic wealth. In developed and developing countries AI is likely to boost GDP growth and could increase the average business profit margin in some sectors by as much as +40%. The research analysis summarized in the chart above translates into $14 trillion of additional economic activity by 2035. Even in the short- and medium-term, AI offers investors a once in a lifetime opportunity to invest in a world changing technology.

AI exposure in the Dominion Global Trends Funds

Dominion is dedicated to investing in Global Trends, the structural changes underway in the global economy that will shape the future economy. AI is already an important trend for Dominion’s investment funds and will continue to be a core investment trend for the foreseeable future. Dominion’s investment process in AI (Dominion AI investments in bold below) has been to find companies that have a data advantage combined with leading AI expertise. This enables those businesses to create systems which are better than their competitors and will continue to get better over time. This creates competitive moats allowing for these successful companies to dominate an industry and generate significant profit margins.

A massive data advantage over their competitors has allowed Alphabet (Google) and Facebook to dominate the internet search, short form video and social network markets in the Western world. They can match users to the best search result or social interaction, often a result which is more engaging than a given user would have chosen themselves, making the platforms better over time and causing users to spend more time within their ecosystem. These companies can monetize this by showing users advertisements. These advertisements are matched to specific consumers, on an individual level, by AI algorithms which have an unparalleled knowledge of the individual consumer. This is AI in action. Such accurate ad matching is highly valuable to advertisers and has allowed Alphabet and Facebook to take c.70% of all online marketing spend in the US, with only Amazon looking able to significantly challenge the duopoly. AI stretches far beyond just advertising. It is critical for content curation on YouTube and Spotify and matching potential couples on Tinder and Match.com’s dating platforms. AI is fundamental to building computer games (the world’s largest entertainment sector), for automated driving and cloud computing. AI is not just a Western phenomenon either. China’s internet giants are making great strides in deploying AI, with companies like Baidu and Alibaba amongst the leading players globally. Automated driving remains in the development stage, but it will transform the world. This is a technology driven entirely by AI. Aptiv is a global leader in developing and producing the automated braking and driver assist systems that automate driver functions in modern vehicles and the company is at the forefront of developing higher levels of automated systems which utilize AI.

Cognex is a company whose products connect to AI systems in the industrial and logistics sectors. The company’s sensor products are critical to automating industrial applications and robotics, and these systems are increasingly being driven by more sophisticated AI technology.

As AI technology continues to develop, Dominion will continue to look at future opportunities to invest in this exciting space. This is an important attribute of Dominion’s actively managed funds, the ability to adapt over time and ensure investors exposure remains optimized to the best long-term AI investment names.